Receipt For Tax Deductible Donations

And you must provide a bank record or a payroll-deduction record to claim the tax deduction. Cash donations of 250 or more.

Free Special Olympics Donation Receipt Template Pdf Eforms

Incorporated or unincorporated organisations and their tax.

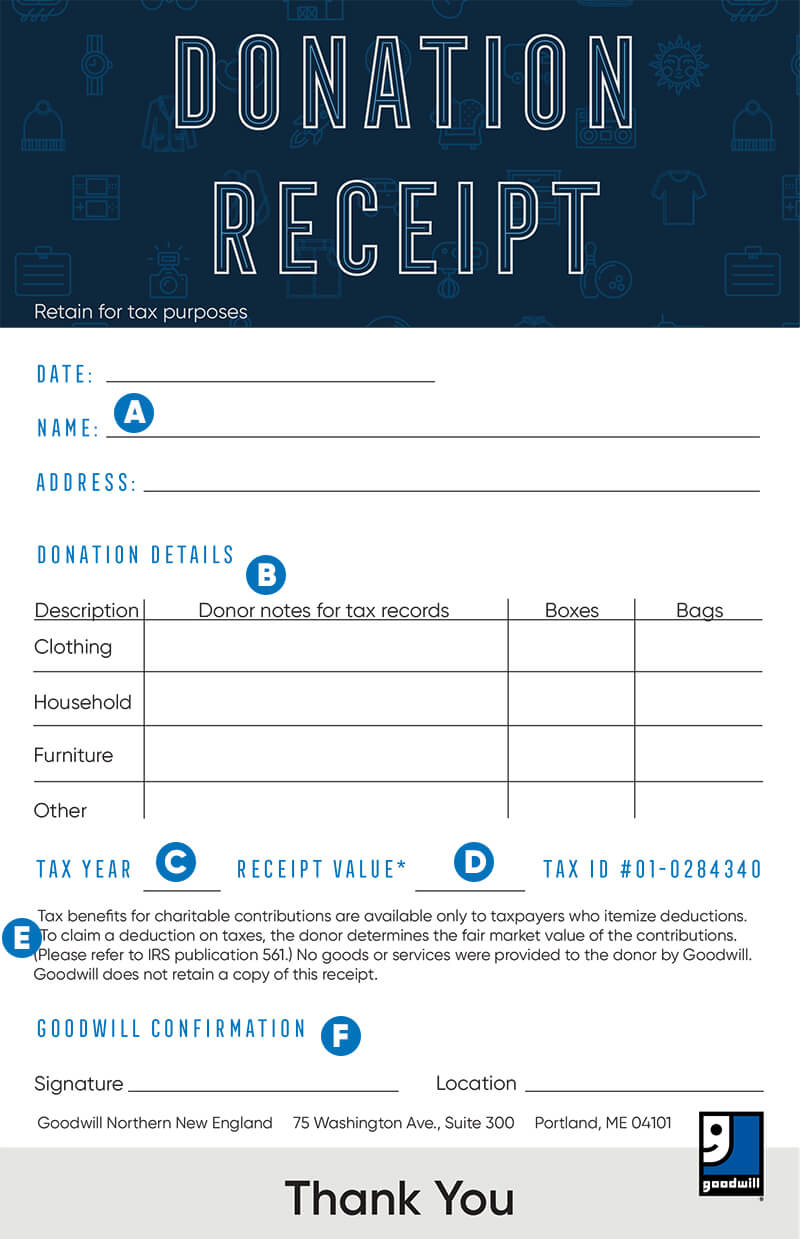

. Amount of deduction. Goodwill Central Coast information for tax return with address of your donation center. Updated June 03 2022.

Reliance on Tax Exempt Organization Search. If claiming a deduction for a charitable donation without a receipt you can only include cash donations not property donations of less than 250. However as a best practice charities may want to do so anyway.

Additionally a statement should appear on the donor receipt indicating that the contribution deductible for income tax purposes is limited to the excess money contributed over the value of that received. Tax-deductible is an expense that can be subtracted from the taxpayers gross income to get adjustable gross income reducing the tax liabilityWhen taxable income is reduced you pay less tax. We are unable to do home pick-ups.

Public charities and private foundations formed in the United States are eligible to receive tax-deductible charitable contributions. Offer period March 1 25 2018 at participating offices only. The tax receipt also includes information on the level of Australian Government gross debt for.

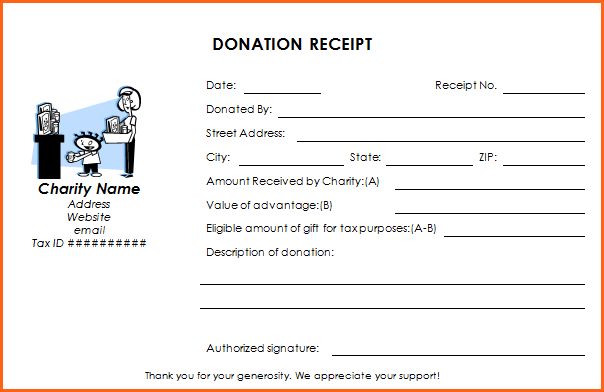

Goodwills 2022 Acceptable Donations List. In the world of taxes tax deductibles are one of the few things that work in the favor of the taxpayer and reduce taxes for both. A 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or moreIts utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction.

Understanding your tax receipt. Registered and incorporated it will pay the company tax rate 28. How much can you deduct for the gently used goods you donate to Goodwill.

The IRS requires an item to be in good condition or better to take a deduction. Goodwill will be happy to provide a receipt as substantiation for your contributions in good used condition only on the date of the donation. The tax receipt contains a table that shows how your taxes are allocated to key categories of government expenditure.

You need a receipt and other proof for both of these. To claim tax deductible donations on your taxes you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction.

A general rule is that only 501c3 tax-exempt organizations ie. They may be deductible as trade or business expenses if ordinary and necessary in the conduct of the taxpayers business. Charities rely on the generosity of the people who donate money to support them without the generosity of people like you they wouldnt be able to do the great things they.

Donations for 75 or less are generally excluded from this reporting. The federal tax law permits you to use any reasonable valuation method for most property contributions as long as it assesses a value that relates to the price a willing buyer would pay for identical property in the open market. Except as indicated above contributions to a foreign organization are not deductible.

It really is the definition of a win win. Since donations made to churches and non-profit organizations are tax-deductible you will get an added benefit other than feeling good knowing you are supporting a worthy cause. The IRS allows you to deduct fair market value for gently-used items.

A deduction for a contribution to a Canadian organization is not allowed if the contributor reports no taxable income from Canadian sources on the United States income tax return as described in Publication 597 PDF. Unincorporated it will pay tax based on the individual tax rate. The rate at which you will pay tax is.

Your donations to Goodwill are tax deductible. The organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

You can find all donation sites here. If your not-for-profit is. To find a list of items we cannot accept please scroll to the next section.

Individuals can support their local church and in exchange get a receipt to use for their taxes. Donations should be clean safe and resaleable. May not be combined with other offers.

To qualify tax return must be paid for and filed during this period. Tax deductible donations can reduce taxable income. What Does Tax-Deductible Mean.

Contributions to civic leagues or other section 501c4 organizations generally are not deductible as charitable contributions for federal income tax purposes. Donations are the lifeblood of many churches. The sample table below provides an example of how this information is presented on your tax receipt.

Our stores take gently used items in good condition. Eligible donations of cash as well as items are tax deductible but be sure that the recipient is a 503c3 charitable organization and keep donation receipts. Tax deductible donations are a great way to give your tax refund a boost while contributing to a worthy cause you care about.

When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches. The amount you can deduct is equal to the value of all cash and property you donate to the school district programs. The quality of the item when new and its age must be considered.

What is Tax Deductible. If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction.

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

An Outline Of Donation Receipts And The Tax Deduction Process Cascade Business News

Complete Guide To Donation Receipts For Nonprofits

How To Fill Out A Donation Tax Receipt Goodwill Nne

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free Goodwill Donation Receipt Template Pdf Eforms

Mastering The Donation Receipt Steal These Invaluable Tips Must Have Elements Templates By Miles Anthony Smith Medium

Tax Receipt Sweet Cheeks Diaper Bank

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Comments

Post a Comment